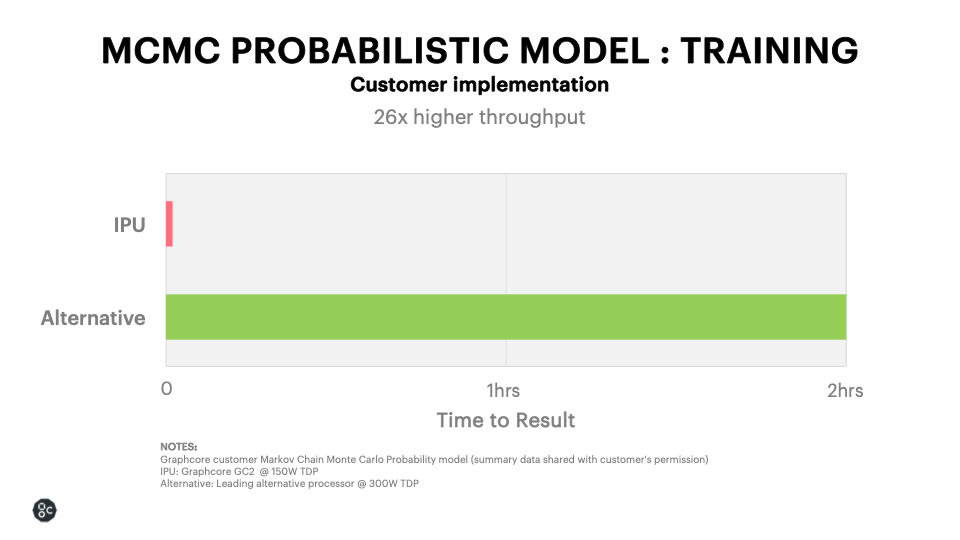

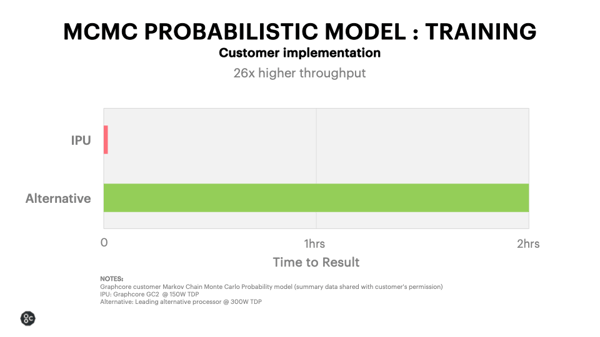

Customers seeing up to 26x performance gains on probabilistic Markov Chain Monte Carlo models using IPUs

Training on IPU takes 4.5 minutes compared to 2 hours with existing solutions.

Increasingly finance companies are using AI to improve algorithmic trading, market making, investment strategies and to improve investment performance. Machine learning is being used to uncover complex patterns, trends, and relationships that can’t easily be detected by humans.

While significant performance gains have been seen, current hardware is holding developers back. The Graphcore IPU has been designed from the ground up to support more advanced machine intelligence techniques. The IPU can support probabilistic machine learning models that take note of or disregard noise, deal with random vectors and handle a high degree of uncertainty. Probabilistic machine learning models have applications in many sectors including drug discovery, work on new materials, for decision making and for better forecasting and prediction. One area in particular that can benefit from these new models is in financial markets.

Evolution of Financial Modelling

For the financial sector, having the right intelligence is critical. As multiple financial agents, with very asymmetric information, transact on stock exchanges and brokerages, this creates an enormous amount of information – trillions of data points on different companies, commodities, economies and individual behaviours all impact the fluctuations in market value and, ultimately the value of financial assets.

The necessity to extract useful insight from all this information is acute. Additional knowledge of the behaviour of a market can be the difference between the success and failure of a fund that you may rely on as part of your pension portfolio. Understanding why certain stocks are acting in a certain way now can help fund managers predict their future movements. Sifting through the sheer amount of entropy within the market to uncover relevant data is a gargantuan task .

Classical statistical models such as linear regression have accuracy limitations when applied to time series analysis and financial forecasting. Linear regression relies on the assumption that all the data points are fully independent and they do not take into account any relationships between data points. However, in time series analysis such as in stock price pattern prediction models, the relationships between data points is clearly extremely significant.

Newer probabilistic models are better equipped to handle the chaotic but often inter-related variables of the financial markets. The beauty of probabilistic modelling is that it enables quantitative researchers to identify an area in the space of parameters where a true distribution is likely to be, as opposed to relying on point estimates that may simply be overfit estimates with the lowest error. This can help researchers gain a more robust and accurate sense of market activity.

Markov Chain Monte Carlo (MCMC) is a new type of probabilistic machine intelligence model that is well suited to these time series analysis problems. MCMC models are able to produce a probability distribution based on a set of continuous random variables, using current known data points. A degree of uncertainty can therefore be introduced into the model, which is far more reflective of the true volatility of the market.

Graphcore delivers up to 26 x performance gains with MCMC

Until now, MCMC models have been perceived as computationally expensive since they take very much longer to run on processors like GPUs and CPUs when compared to linear regression - the Graphcore IPU removes this bottleneck.

Early access IPU customers in the finance sector have been able to train their proprietary, optimised MCMC models in just 4 ½ minutes on IPUs, compared to over 2 hours with their existing hardware. This represents a 26x speed up in training time. Even when using non-optimised, off-the-shelf TensorFlow code, IPUs will train Probabilistic models in just 45 minutes compared to 400 minutes on the next best alternative.

George Sokoloff, Founder and CIO at hedge fund, Carmot Capital, said: "The set of models the world uses today for financial analysis are too simplistic. In finance, the vast majority, from the average asset manager all the way up to global monetary authorities, like the ECB or the Fed, are still using models based on 19th century calculus and 20th century statistics. This is a huge problem as these simplistic models do not allow us to capture the non-linear, unstable and oftentimes chaotic nature of financial markets."

“What’s interesting is we already have the solution. Recent, more complex machine learning models can provide much deeper insight into what is happening in the financial world – but they are too computationally expensive to run on existing processors. Now imagine running these more complex models significantly faster, with a processor built to accelerate highly complicated models like Graphcore’s IPU. The benefits – both from a finance and from a global economy perspective – would be immeasurable.”

“We were able to train one of our proprietary probabilistic models, based on an MCMC implementation in 4.5 minutes instead of 2 hours, in our initial work testing IPUs. That’s 26x faster time to train than other leading platforms with the highest levels of accuracy. We look forward to continuing to explore the IPU’s potential to accelerate machine intelligence.”

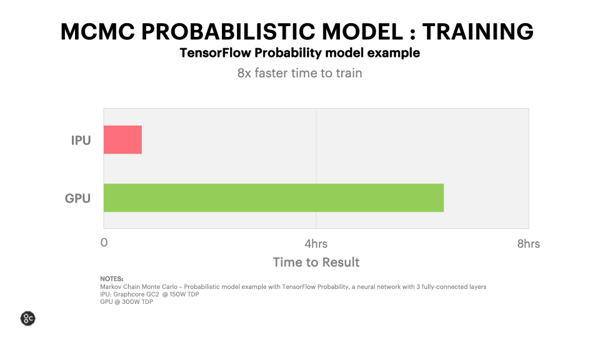

MCMC Implementation using TensorFlow

We also took an off-the-shelf TensorFlow Probability (TFP) implementation to assess the performance of probabilistic models on IPU comparing against other leading hardware accelerators.

What we discovered was that even when implemented using standard TensorFlow code and not including any optimisations, the probabilistic models still train 8x faster on an IPU compared to the next best alternative.

In this example the model is a neural network with 3 fully connected layers. The input data are features, generated from a time series of stock prices. Distributions of model parameters are represented by their samples. The samples are obtained using the Hamiltonian Monte Carlo (HMC) algorithm, which is an MCMC method, efficient in high-dimensional cases. Sampling is performed in a sliding time window on subsets of the data. This is done to test the historical predictive power of the model. Using the IPU platform we were able to train the model in 45 minutes down from over 6 ½ hours on the best alternative processor.

MCMC applications

In the case of alpha estimation, the intelligence that could be uncovered by faster MCMC modelling would allow fund managers to continuously update their models and predict more accurately where they might find a return and why – discovering the drivers of stock returns even when the model is faced with many different variables.

Financial risk management is another area where MCMC models can give deeper insight into the unpredictable financial events which are known as “black swans”. Unpredictable events cannot easily be modelled using existing methodologies. Many risk practitioners will use CVaR (Conditional Value at Risk) or a Markovian approach to model their financial risk over time. But in order to estimate the non-linear nature of risk, non-linear models have to be run, which is where machine learning can provide value. MCMC models in particular can help quantitative researchers to estimate non-linear risk factors that may come up in future.

Within option pricing, the aim is to determine the future price of a certain derivative of a particular financial instrument and to create a model of its behaviour. However, this model can be “fat-tailed”, meaning that there will be many outliers within the model and many unusual behaviours – making the act of forecasting option pricing itself very complicated. By pricing certain non-linearities into potential returns using an MCMC model, financial agents are able to better understand what the distribution of returns on a given asset will be.

On a broader societal level, the field of monetary policy could be very positively impacted by the adoption of MCMC. The fundamental building blocks of how our economies are modelled – including fiscal policies, global trade, savings, consumption, interest rates, stock markets – could be supported by greater and more accurate insight into the variables that impact financial activity.

We predict that the usage of MCMC will grow substantially as researchers begin to build more complicated models of financial assets, enabled by Graphcore IPU technology. The combination of IPU accelerated processing and innovative MCMC modelling could vastly improve market insight for the finance industry and improve economic modelling more generally.

For more information or to be contacted by one of our sales team please register your interest here.